In recent years, numerous borrowers have raised concerns over the practices of Kennedy Funding, a prominent player in the hard money lending industry. The company, known for providing large-scale loans for real estate investments, has faced a surge of complaints and negative feedback. As a result, many individuals searching for financial assistance or looking to invest in properties have turned to the “Kennedy Funding ripoff report” to uncover the truth about these allegations.

This report aims to delve deeper into the various accusations against Kennedy Funding, providing an unbiased view of the company’s practices. From hidden fees to questionable lending terms, potential borrowers need to understand the risks involved before committing to any loan. By reviewing customer experiences and evaluating the company’s overall reputation, we can better assess whether the complaints about Kennedy Funding are valid or exaggerated. In this post, we’ll provide an honest look at the claims surrounding this lender, ensuring you have the information you need to make an informed decision.

Is Kennedy Funding a Scam? What Borrowers Need to Know Before Signing a Contract

When it comes to securing a loan, especially in real estate, it’s crucial to choose a lender that you can trust. Kennedy Funding, a well-known hard money lender, has attracted its fair share of attention in recent years. But with that attention has come an increasing number of complaints and reports of unsatisfactory experiences. If you’re considering working with them, it’s important to understand what others are saying and weigh the potential risks before you sign any contracts.

One of the first things to note is that Kennedy Funding specializes in large-scale loans for real estate investments. This niche market means they often work with individuals or businesses looking for substantial amounts of money quickly, without the lengthy approval processes typical of traditional banks. While this might seem like a convenient option for many borrowers, it also comes with certain drawbacks that could be perceived as predatory or risky.

Many people who have used Kennedy Funding’s services have reported concerns regarding hidden fees and overly complex loan terms. In some cases, borrowers claim that the terms of the loans were not clearly explained upfront. This lack of transparency can lead to frustration and confusion, especially when repayment schedules or interest rates turn out to be higher than expected.

Another complaint often voiced by dissatisfied customers is the company’s aggressive collection practices. Some borrowers have shared experiences where they felt pressured or intimidated during the repayment process. These reports have fueled the perception that Kennedy Funding might be less focused on supporting borrowers and more interested in profit, which has led some to label the company a “scam.”

Hidden Fees and Complicated Loan Terms

One of the biggest red flags mentioned in many Kennedy Funding reviews is the presence of hidden fees. These fees can add up quickly, making what initially seemed like an affordable loan much more expensive in the long run. Some borrowers have reported that the terms regarding these fees were not clearly outlined in their contracts, leading to unpleasant surprises when it came time to repay the loan.

The interest rates on loans offered by Kennedy Funding can also be much higher than what is found with traditional lenders. While hard money loans generally carry higher interest rates due to the risk involved, some customers feel that the rates charged by Kennedy Funding are particularly steep. If the fees and interest rates aren’t fully disclosed or explained, borrowers might find themselves in a financially precarious situation.

Real Customer Reviews: The Good and the Bad

When researching Kennedy Funding, it’s essential to look at customer reviews to get a true sense of the company’s reputation. There are some borrowers who have had positive experiences with the lender, praising the quick approval process and flexibility in loan options. However, these reviews are often overshadowed by the negative feedback regarding misleading loan terms and poor customer service.

The contrast between the good and bad reviews can be stark, and it’s important to keep in mind that some individuals may be more prone to sharing negative experiences. However, a recurring theme in the complaints is the frustration over communication issues. Borrowers often report difficulty reaching representatives or feeling that their concerns were not taken seriously.

Loan Approval Process: Fast but Risky?

One of the main appeals of Kennedy Funding is their ability to provide fast loans, often approving requests within days or even hours. For those in need of quick funding, this can seem like an ideal solution. However, the speed of the approval process also raises questions about the company’s thoroughness in reviewing loan applications and ensuring that the terms are fair for the borrower.

The quick turnaround can lead to borrowers making hasty decisions without fully understanding the terms or consequences of their loans. While time is of the essence for many real estate investors, rushing into a financial agreement without proper due diligence can lead to regret and potential financial distress down the road.

How Does Kennedy Funding Compare to Other Lenders?

When assessing whether Kennedy Funding is a scam, it’s important to compare them to other lending options available in the market. Traditional banks, for example, offer lower interest rates and clearer terms but often require a lengthy approval process. On the other hand, other hard money lenders may offer similar quick approvals but with more transparent terms and fewer complaints from customers.

In comparison, Kennedy Funding may seem like a riskier option due to the negative experiences shared by many borrowers. The key difference often comes down to the company’s communication and the clarity of their contracts. If you’re considering Kennedy Funding, it’s crucial to compare their loan terms with other lenders to ensure you’re getting a fair deal.

The Importance of Reading the Fine Print

One of the most important steps in securing a loan, whether with Kennedy Funding or any other lender, is reading the fine print. While it can be tempting to rush through the process, especially when you need the funds quickly, failure to carefully review all terms and conditions can lead to costly mistakes.

Many of the complaints against Kennedy Funding revolve around borrowers not fully understanding the terms they agreed to. This could include clauses about penalties, fees, or payment schedules that were not made clear from the start. Before signing anything, make sure you understand the loan structure and have had all your questions answered to avoid being blindsided later.

The Role of Customer Service in Your Experience

Another common grievance voiced by customers is the lack of support from Kennedy Funding’s customer service team. Many borrowers report difficulties in getting their concerns addressed or feel that their needs are not a priority for the company. This lack of communication can exacerbate frustrations and contribute to the feeling that the company is not acting in the borrower’s best interests.

Good customer service is essential for any financial institution, especially one dealing with large loans. When issues arise, having a responsive team to guide you through the process can make a significant difference in your overall experience. Unfortunately, many people’s experiences with Kennedy Funding have fallen short of this expectation.

Should You Proceed with Kennedy Funding?

Deciding whether or not to work with Kennedy Funding depends on your specific situation. While some borrowers have had success with their loans, the numerous complaints and reports of hidden fees and aggressive practices should not be ignored. If you’re considering working with them, take the time to thoroughly vet the company and ensure that you understand the terms of your loan.

It’s also wise to consult with a financial advisor or legal professional before signing any agreement. By doing so, you can get a clearer understanding of whether this lender is a good fit for your needs or if you should look elsewhere for financing.

The Bottom Line: Is Kennedy Funding Worth the Risk?

Ultimately, the decision to work with Kennedy Funding comes down to your risk tolerance and financial goals. While they may offer quick loans with flexible terms, the potential pitfalls—such as hidden fees, high interest rates, and questionable business practices—could outweigh the benefits. Conduct thorough research, read the fine print, and consult with experts to determine if Kennedy Funding is the right choice for you.

Exploring the Allegations: A Comprehensive Look at Kennedy Funding’s Reputation

Kennedy Funding has made a name for itself in the hard money lending industry by offering quick loans to real estate investors. However, with its rise in popularity, numerous complaints have surfaced, leaving potential borrowers skeptical about the company’s practices. Allegations of deceptive terms, hidden fees, and unethical lending practices have led to a significant number of people searching for answers. It’s essential to carefully evaluate the accusations to understand whether these concerns are based on legitimate grievances or if they stem from misunderstandings.

One of the most significant complaints against Kennedy Funding involves the hidden costs that borrowers often claim they were not informed about initially. Many individuals have shared experiences where they were not fully aware of the high interest rates and additional charges that would accrue over the life of their loans. These surprise fees can make the loan significantly more expensive than initially anticipated, and borrowers have expressed frustration about not being properly informed during the loan approval process.

In addition to hidden fees, some borrowers report that the terms of their loans were far less favorable than initially agreed upon. Many of these complaints revolve around the fine print in the loan agreement, which allegedly contains clauses that give Kennedy Funding more power over the loan structure than initially disclosed. This can create an imbalance, leaving borrowers feeling trapped in unfavorable loan terms they were not prepared for.

Another common allegation is the company’s aggressive tactics in pursuing payments. Some borrowers claim that Kennedy Funding used harsh measures, including threats of foreclosure, in order to ensure timely payments. While some lenders have been known to take strong actions to secure their loans, these aggressive tactics have led to criticisms that Kennedy Funding is prioritizing its interests over its clients’ well-being. Such tactics can leave a borrower feeling stressed and pressured, particularly if they are already struggling financially.

Furthermore, numerous complaints highlight a lack of customer support and unresponsiveness when issues arise. Borrowers have reported difficulty in reaching a representative from Kennedy Funding, particularly when attempting to address concerns or resolve conflicts related to loan terms. This lack of accessibility has left many borrowers frustrated, feeling that their concerns are being ignored rather than properly addressed.

On the other hand, some borrowers have had positive experiences with Kennedy Funding, noting that the company was able to provide fast and efficient funding when traditional lenders would not. These borrowers often argue that while the terms may not be the best, they were in a situation where they had few other options. For them, Kennedy Funding’s quick approval process made it possible to secure funding for investment projects they may not have been able to pursue otherwise.

Despite the negative reports, Kennedy Funding has made attempts to address some of the complaints by offering more transparency in its communications with potential borrowers. The company has reportedly improved its explanation of loan terms, fees, and the loan repayment process. While these improvements are a step in the right direction, many customers feel that more still needs to be done to ensure that everyone fully understands what they are agreeing to before signing on the dotted line.

The mixed reviews surrounding Kennedy Funding’s reputation make it difficult for potential borrowers to assess the company’s trustworthiness. While some individuals have had positive experiences, many others have voiced strong discontent about the company’s practices. This disparity in customer satisfaction has fueled ongoing debates about whether Kennedy Funding is a legitimate, reliable lender or simply a business focused on maximizing its profits at the expense of its clients.

For individuals considering borrowing from Kennedy Funding, it’s crucial to weigh the pros and cons carefully. Researching the company’s history, reading customer reviews, and consulting with legal professionals can help potential borrowers make an informed decision. Additionally, it’s always recommended to explore other lending options to compare terms and rates, ensuring that you are securing the best deal possible.

the allegations against Kennedy Funding are varied and complex, making it essential for prospective clients to do their due diligence before engaging with the company. While some complaints may be valid, it’s also possible that a number of borrowers had unrealistic expectations going into their loan agreements. Regardless of the situation, having a clear understanding of the loan terms, fees, and repayment structure is key to avoiding any potential issues down the road.

Real Customer Experiences: What People Are Saying About Kennedy Funding’s Practices

When considering a financial institution or lending company, it’s essential to understand the experiences of those who have worked with them. Customer reviews and firsthand accounts offer valuable insights into what borrowers can expect. In the case of Kennedy Funding, real customer experiences have been mixed, with many people expressing frustration over various aspects of their dealings with the company. Understanding these customer reviews can help you determine whether the company’s practices align with your expectations.

Several borrowers have reported issues with Kennedy Funding’s loan terms, particularly in relation to the interest rates and fees. Some claim they were not fully informed about the high costs of borrowing upfront. One common complaint is the significant origination fees attached to loans, which often seem much higher than what borrowers initially anticipated. As a result, many customers feel that the overall financial burden became more substantial than they had planned for.

On the other hand, some borrowers have praised Kennedy Funding for their quick and efficient service. Several individuals noted that the company was able to process their loans faster than traditional lenders, which was crucial when they were in need of immediate funds. For real estate investors, this speed can be a significant advantage, especially in competitive markets where time is a critical factor.

However, other customers have shared experiences of poor communication throughout their dealings with Kennedy Funding. Many have mentioned that they found it difficult to reach representatives or get answers to important questions. When communication breaks down, it creates a sense of frustration and uncertainty, leaving borrowers feeling disconnected from the process. This lack of clarity has been a major concern for some customers, particularly when they had to make critical decisions regarding their investments.

A number of reviews also mention the challenges borrowers face when dealing with Kennedy Funding’s underwriting process. Some customers feel that the company was overly stringent in their approval process, rejecting loans that appeared promising or requiring additional documentation without clear explanations. These roadblocks can make the process feel cumbersome and discouraging for those who are trying to secure financing quickly.

Another significant issue raised by some clients is the lack of flexibility in loan terms. Kennedy Funding, like many hard money lenders, often imposes rigid repayment schedules and conditions. For individuals who experience financial hardships or unexpected events, the inflexibility of these terms can lead to added stress. Several customers have expressed dissatisfaction with the company’s unwillingness to adjust terms in response to changing circumstances.

There have also been mentions of high-pressure tactics used by some representatives of Kennedy Funding. Some borrowers claim that they were rushed into signing agreements without fully understanding the consequences of the terms. This type of aggressive sales approach can leave clients feeling overwhelmed and uncertain, especially when they’re not given ample time to review the fine print.

Despite the mixed reviews, some customers have shared positive experiences about their long-term relationships with Kennedy Funding. These individuals report that, after their initial concerns were addressed, the company lived up to their promises. They highlight the importance of maintaining communication and following up on any unresolved issues, as some of these customers felt that their experiences improved after they voiced their concerns.

Customer feedback also suggests that Kennedy Funding may be more suitable for experienced investors rather than first-time borrowers. Many of the individuals who were satisfied with their loans had previous experience with hard money lenders and were more familiar with the associated risks and terms. For those new to the world of real estate investments, the complexity of the process and the associated costs may be overwhelming without a clear understanding of how hard money lending works.

the experiences of borrowers with Kennedy Funding are varied, with both positive and negative accounts emerging from customers. While some people have found the company’s service to be fast and effective, others have faced challenges related to hidden fees, poor communication, and strict loan terms. It’s crucial for prospective clients to carefully research Kennedy Funding and assess whether they are comfortable with the terms and conditions of the loans before making a commitment.

Kennedy Funding’s Impact on the Real Estate Market: Fact or Fiction?

Kennedy Funding, a well-known hard money lender, has been a significant player in the real estate industry for decades. The company primarily provides loans for commercial real estate transactions, often for properties that traditional lenders may avoid. With its reputation for offering quick funding and flexible loan terms, Kennedy Funding has garnered both praise and criticism. But how much of an impact has this lender truly had on the real estate market? Is it as influential as it claims, or are the reports of its practices exaggerated?

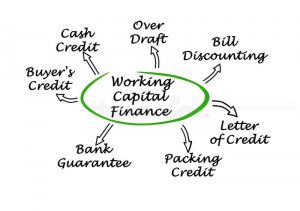

The Role of Hard Money Lenders in Real Estate

Hard money lenders like Kennedy Funding fill a unique niche in the real estate market, offering loans to borrowers who may not qualify for traditional bank financing. These loans are typically secured by the property itself rather than the borrower’s creditworthiness, which means they are often used for investment properties, fix-and-flip projects, or large commercial deals. While the speed of approval and funding can be attractive, the high-interest rates and fees associated with hard money loans can be daunting for some.

Kennedy Funding’s Market Position: A Game Changer?

Kennedy Funding has positioned itself as a leading source of capital for real estate projects that require quick and substantial funding. Over the years, the company has financed numerous large-scale projects, including commercial developments, multifamily units, and industrial properties. Its ability to provide funding quickly has allowed investors to seize opportunities that may otherwise be missed. However, critics argue that its business model can lead to over-leveraged investments and risky financial decisions.

The Controversy Surrounding Kennedy Funding’s Lending Practices

Despite its success in securing high-profile loans, Kennedy Funding has faced scrutiny regarding its lending practices. Many borrowers have reported feeling misled by the company’s terms, which are often seen as opaque or overly complicated. Critics claim that the company’s loan agreements are riddled with hidden fees, and some have even gone so far as to call it a “ripoff” due to its expensive rates and conditions. This controversy has led to negative reviews and widespread skepticism about the company’s impact on the market.

Are the Allegations of Misleading Terms Justified?

While some borrowers have expressed dissatisfaction with Kennedy Funding’s terms, it’s important to consider the nature of hard money loans. These loans are typically designed for short-term projects, meaning the interest rates and fees are often higher than those of traditional loans. However, borrowers should always fully understand the terms before committing. Some of the negative feedback could stem from a lack of clarity in the loan documents, which might contribute to feelings of frustration or misunderstanding.

Impact on Real Estate Investors: Opportunities vs. Risks

For real estate investors, Kennedy Funding can offer significant advantages, especially for those needing fast financing to close deals. Its ability to approve and fund loans quickly can give investors a competitive edge in the fast-paced real estate market. However, the high interest rates and short repayment periods also come with substantial risks. Investors must weigh the potential for high returns against the likelihood of falling into financial hardship if their projects don’t go as planned.

The Positive Side: Success Stories and Growth

Despite the controversies, there are numerous success stories from borrowers who have found Kennedy Funding to be a valuable partner in their real estate ventures. Many investors have been able to complete large-scale projects that would have otherwise been out of reach due to traditional lending restrictions. These success stories help to paint a picture of Kennedy Funding as a key player in helping investors access capital when banks and other lenders are unwilling to do so.

How Kennedy Funding’s Loans Affect Property Values

Kennedy Funding’s loans are often used to finance properties that are in need of significant repairs or improvements. As a result, many of the properties funded by the company eventually see an increase in value once the necessary work is completed. This can have a positive ripple effect on the surrounding real estate market, as improved properties often lead to higher property values in the area. However, the high-risk nature of these loans means that not all projects achieve the desired outcome, which can lead to negative impacts on property values if the projects fail.

The Legal and Regulatory Scrutiny of Kennedy Funding

As with any large financial institution, Kennedy Funding has faced legal challenges over the years. The company has been subject to regulatory scrutiny, especially concerning its lending practices. Some critics argue that the company’s terms are predatory, while others believe it operates within the bounds of the law. Understanding how these legal and regulatory factors influence Kennedy Funding’s operations is essential for investors and borrowers alike, as they directly impact the company’s ability to continue operating at its current scale.

Kennedy Funding’s True Impact

In conclusion, Kennedy Funding’s impact on the real estate market is a complex one. The company has undoubtedly provided valuable funding for many successful projects and has allowed investors to pursue opportunities that would have been otherwise unavailable. However, the company’s practices have also raised concerns about the fairness of its terms and the risks associated with hard money lending. Whether Kennedy Funding is a beneficial resource or a dangerous pitfall largely depends on the individual borrower’s ability to navigate its terms and the specifics of their investment strategy. For those who understand the risks and benefits, Kennedy Funding can be a powerful tool in the real estate market—but for others, it might be a financial trap.

| Aspect | Details |

|---|---|

| Company Overview | Kennedy Funding is a hard money lender specializing in large-scale loans for real estate investments. |

| Loan Types Offered | Primarily offers commercial real estate loans, fix-and-flip loans, and loans for development projects. |

| Interest Rates | Interest rates are higher compared to traditional lenders due to the risk profile of hard money loans. |

| Loan Terms | Short-term loans with repayment periods typically ranging from 6 months to 5 years. |

| Complaints & Allegations | Borrowers have raised concerns about hidden fees, opaque terms, and high-interest rates. |

| Customer Feedback | Mixed reviews; some borrowers appreciate quick funding, while others feel misled by unclear terms. |

| Legal & Regulatory Scrutiny | Kennedy Funding has faced legal challenges and regulatory reviews concerning its lending practices. |

| Impact on Real Estate Market | The company has financed many successful real estate projects, improving property values in some cases. |

| Risks for Borrowers | High fees and interest rates can lead to financial hardship if projects do not succeed. |

| Success Stories | Many real estate investors have successfully completed projects with Kennedy Funding’s assistance. |

Conclusion: Is Kennedy Funding Worth the Risk?

Kennedy Funding has made a significant impact in the real estate lending space, offering quick access to capital for commercial and investment properties. While the company’s ability to provide fast funding and flexible terms has helped many investors seize opportunities, the concerns raised in “Kennedy Funding ripoff reports” cannot be overlooked. Allegations of hidden fees, high-interest rates, and unclear loan terms are valid issues that potential borrowers must carefully consider.

For some, Kennedy Funding has proven to be a valuable resource, enabling successful real estate projects that may not have been possible through traditional lenders. However, the risks associated with hard money loans, particularly the financial strain caused by their high costs, mean that borrowers must be well-prepared and fully aware of the terms before proceeding.

Ultimately, Kennedy Funding can be a useful tool for experienced investors who understand the potential pitfalls of hard money lending. However, it may not be the best choice for everyone. Borrowers should carefully weigh the pros and cons, conduct thorough research, and ensure they are making an informed decision before entering into any agreements with the company.

- What is Kennedy Funding, and how does it operate in the real estate market? Kennedy Funding is a hard money lender specializing in commercial real estate loans. It provides short-term loans to investors and developers, often for projects that traditional lenders may avoid due to high risk or unique circumstances.

- Is Kennedy Funding a legitimate company? While Kennedy Funding is a registered company, it has faced criticism regarding its lending practices. Some borrowers report dissatisfaction with its terms and fees. Potential clients should carefully research the company and review loan agreements before committing.

- Why are people concerned about Kennedy Funding’s fees and interest rates? Kennedy Funding is known for offering high-interest rates and additional fees due to the nature of hard money loans. These costs can significantly increase the overall loan repayment, making it crucial for borrowers to fully understand the terms before signing any agreement.

- Can Kennedy Funding help with urgent real estate financing? Yes, Kennedy Funding is often used by investors who need quick access to capital. It provides fast approval and funding, which is especially useful for time-sensitive real estate transactions or developments.

- What are the risks involved in borrowing from Kennedy Funding? The primary risks include high interest rates, hidden fees, and short repayment periods. Borrowers who fail to complete projects or face unforeseen challenges may struggle to repay the loan on time, potentially leading to financial strain.

- What do borrowers say about their experiences with Kennedy Funding? Customer feedback about Kennedy Funding is mixed. While some borrowers appreciate the speed of funding and flexibility, others have complained about unclear terms and excessive fees. It’s important to review all terms carefully before moving forward.

- How does Kennedy Funding compare to traditional lenders? Kennedy Funding operates differently from traditional banks by offering faster loans, but typically with higher interest rates and more flexible terms. Traditional lenders may offer lower rates but tend to have stricter eligibility requirements and longer approval processes.

- Are there any legal challenges related to Kennedy Funding’s lending practices? Yes, Kennedy Funding has been involved in several legal disputes related to its lending terms, particularly around claims of deceptive or unclear practices. Borrowers should be aware of the legal landscape and ensure they fully understand the agreement before borrowing.

- Can Kennedy Funding help fund fix-and-flip real estate projects? Yes, Kennedy Funding specializes in providing loans for fix-and-flip projects. Investors in the real estate market often turn to this company when they need quick funding for property renovations and sales.

- What should I consider before taking a loan from Kennedy Funding? Before securing a loan from Kennedy Funding, it’s crucial to assess your ability to repay the loan on time, the total cost of the loan (including interest and fees), and whether the project is likely to generate the returns necessary to cover the debt. Always read the terms carefully and seek legal or financial advice if needed.